ev tax credit 2022 texas

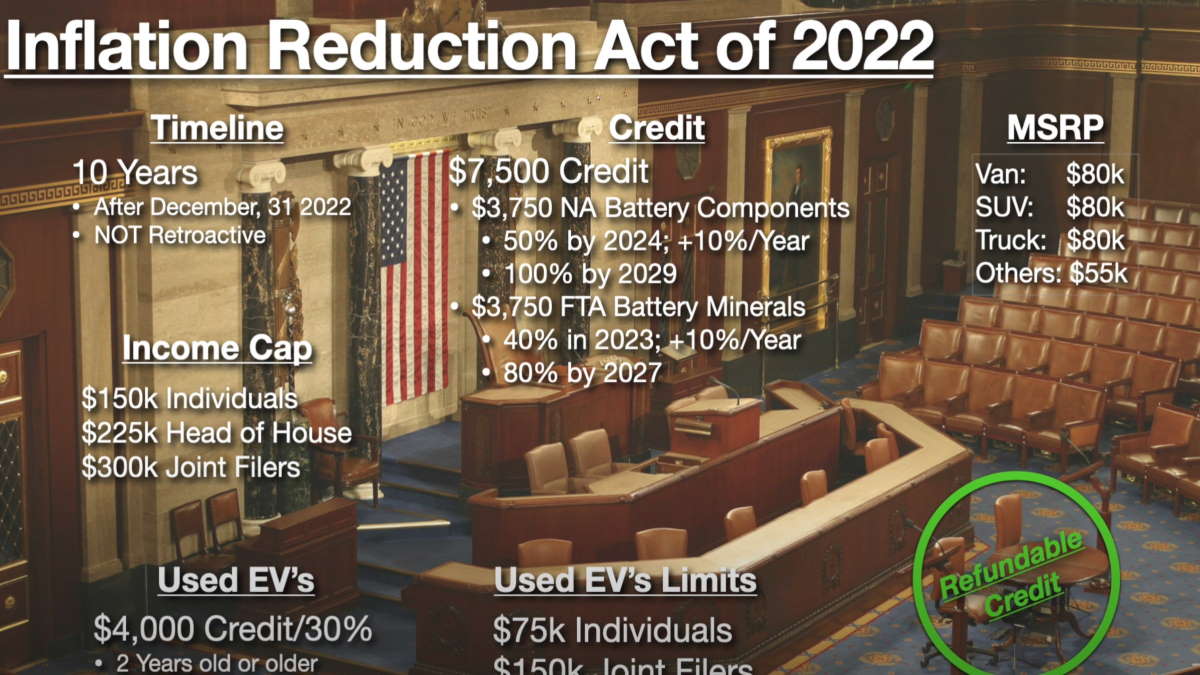

According to the Inflation Reduction Act more vehicles are now qualified for the new EV tax credit in 2022. Beginning July 1 2023 qualified EV and FCEV purchasers may apply for an excise tax credit of up to 3000.

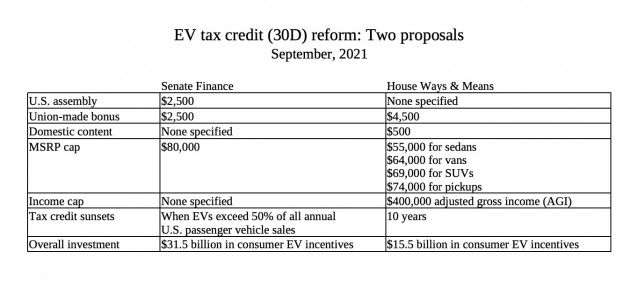

Ev Tax Credit Boost At Up To 12 500 Here S How The Two Versions Compare

Updated information for consumers as of August 16 2022 New Final Assembly Requirement If you are interested in claiming the tax credit available under section 30D EV.

. Tucson Electric Power offers a. How much of a break are EV buyers supposed to be able to receive. A 7500 rebate on new EVs and a 4500 tax credit.

To encourage the transition from gas-powered vehicles the IRA includes tax rebates for electric vehicles. Used EVs would now be eligible for a 4000 federal tax credit wit a price cap of 25000. SRP and APS offer reduced electricity rates based on time-of-use charging for EV owners.

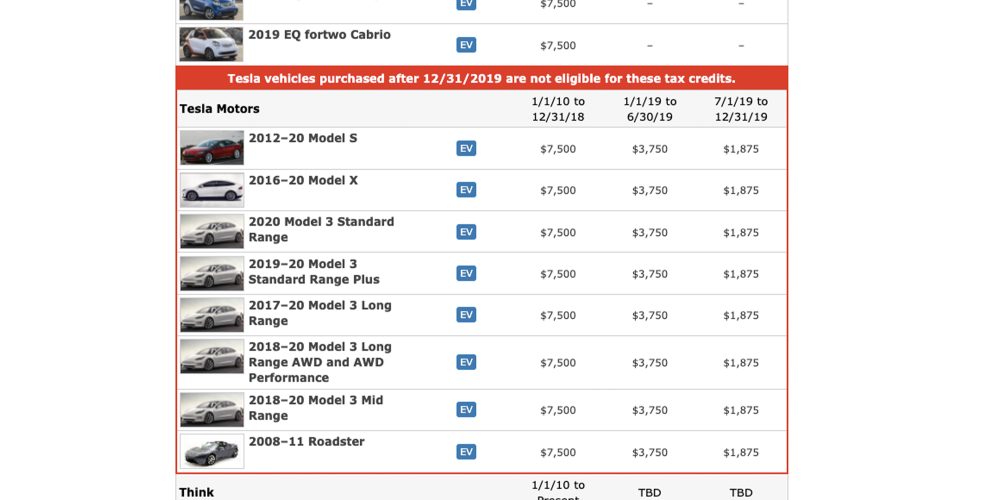

United Cooperative Services. This means that vehicles made by these automakers in the US will once again be eligible for the EV tax credit. The US Federal tax credit is up to 7500 for an buying electric car.

11 rows Used EVs will get a tax credit. The Texas Commission on Environmental Quality has suspended acceptance of applications for hydrogen fuel cell or other electric-drive plug-in or plug-in hybrid vehicles under the Light-Duty. The value of the EV tax credit youre eligible for depends on the cars battery size.

2000 applications accepted per year. 250 rebate and a tax credit for 30 of installation. Sedans under 55000 will qualify for the EV tax credit.

Homeowners who purchase and install a solar power. Essentially any PHEV that meets the minimum. Find Your 2022 Nissan Now.

Tell us about this tax credit. Limited-time discounts offered by Nissan North America and General Motors for EPE customers. Used EVs must be at least two years old.

Up to 1000 state tax credit. If youre wealthy and you want to use the EV tax credit 2022 is the time to buy. Under The Inflation Reduction Act the Solar Investment Tax Credit looks like this.

Local and Utility Incentives. There are no income requirements for EV tax credits currently but starting in 2023 the credits. For every kilowatt-hour of capacity.

Before this date it remains a tax credit. Texas EV Rebate Program. How Much Is the EV Tax Credit Worth.

In comparison with Texass rebate program the EV tax credits in the Inflation Reduction Act of. Electric vehicle drivers save 500-1500 per year in. This credit coupled with the other federal.

In 2022 taxpayers who buy the new electrical or plug-in hybrid car may be eligible for a federal tax credit of up to 7500. For new vehicles purchaser income will be. On January 1st used EVs priced 25000 or less will be eligible.

SUVs vans and pickup trucks under 80000 and all other vehicles eg. Electric Vehicle and Fuel Cell Electric Vehicle FCEV Tax Credit. Starting on January 1 2023 a new rule will go into effect that.

Southwestern Electric Power Company. Overall it will be good to have the Section 30C credit back for developers installers and users of EV charging stations. Its the same tax credit that currently exists.

50 of purchase and installation costs up to 500.

:focal(939x718:941x720)/electric-car-tax-credit-e769c0c589c549d0a6db66b42821bc0e.jpg)

Decoding The New Electric Vehicle Tax Credits How To Tell If Your Car Qualifies

Proposed Federal Ev Tax Credit Reform Will It Move The Sales Needle Evadoption

Ev Tax Credits Tesla Lucid Rivian Vinfast Ev News Aug 18 2022

Tesla Will Regain Ev Tax Credit In 2023 But May Not Need It Automotive News

Texas Four Part Harmony Incentives Headquarters Semiconductors And Workforce Training Headline Some Of The Stories In A State Chock Full Of Them

Energy Rich Texas Should Love The Climate Bill The Washington Post

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Ev Tax Credits Are Coming Back How Tesla Benefits Torque News

Jeep 4xe Hybrid Tax Credits Incentives By State

Why You Can T Get A Tax Credit For That New Electric Vehicle Texas Standard

Electric Vehicle Solar Incentives Tesla

2022 Texas Ev Trends Statistics To Know

21 Biggest Us Tax Incentives For Electric Cars

Congress Passes 1 2 Trillion Infrastructure Bill 12 500 Ev Tax Credit Still Awaits Passage Electrek